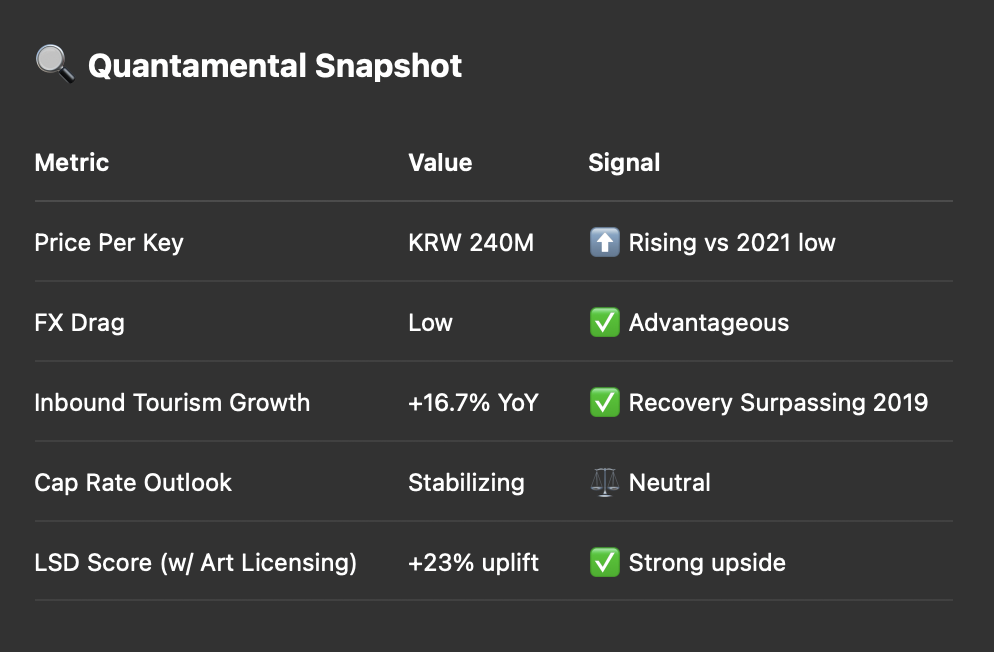

At KRW240 million per key (USD ~$173,000), the valuation reaches 84.5% of its 2019 peak, when the property last sold for KRW14.2 billion. The marginal YoY uptick from KRW11.8B in 2021 to KRW12B in 2025 is less interesting than the contextual macro tailwinds:

The Bay Street FX Drag Score for Korea has fallen 22% YoY, and our Political Flexibility Index places Korea in the 92nd percentile globally. Combined with a reversion in Cap Rate Compression Risk, the market begins to favor small-format, highly-localized, transit-oriented lifestyle hotels — particularly those near cultural or aesthetic nodes like Gwangalli Beach.

In our May conversation with a third-generation Korean collector of minhwa (folk painting) and dansaekhwa (monochrome abstraction), we explored how underwritten hospitality can preserve not just yield, but heritage:

“The value is not in display. It is in continuity. The hotel is not a gallery—it is a living argument.”

This view echoes the thesis in Art Collecting Today, which notes:

“The next evolution of patronage is hybrid: investors and hosts who can both preserve and activate meaning.”

Bay Street believes these transactions — particularly in Busan and Gyeongju — present a unique opportunity for hotel owners to license regional art collections on flexible 5-year, non-ownership terms, giving cultural families influence without divestment.

Our LSD (Long-term Scalable Differentiation) metric shows a +23% uplift in exit valuation when art partnerships are embedded in brand positioning at asset acquisition — particularly in East Asia, where narrative hierarchy matters deeply to both local and foreign guests.

The Gwangan Branch sits in a location Bay Street scores as Tier-2.5 Cultural Adjacency — not in the central heritage belt, but visible from high-intimacy zones like Gwangan Bridge and the beachfront café stretch. This makes it ideal for:

Bay Street’s 2024-25 talks with Busan city planners and regional architecture guilds have identified over 17 beachfront or riverfront properties that are underutilized but possess strong potential for conversion into culturally activated hospitality assets.

Unlike Seoul, where inventory is saturated and land costs create valuation friction, Busan offers asymmetry: meaningful growth, art-friendly partners, and less brand congestion. The Best Louis Hamilton transaction may lack the flash of a luxury pipeline announcement, but its fundamentals align almost perfectly with Bay Street’s thesis: midscale, culturally resonant, and loyalty-capable.

As Management of Art Galleries notes:

“Where context leads, capital follows. The inverse is rarely true.”

...