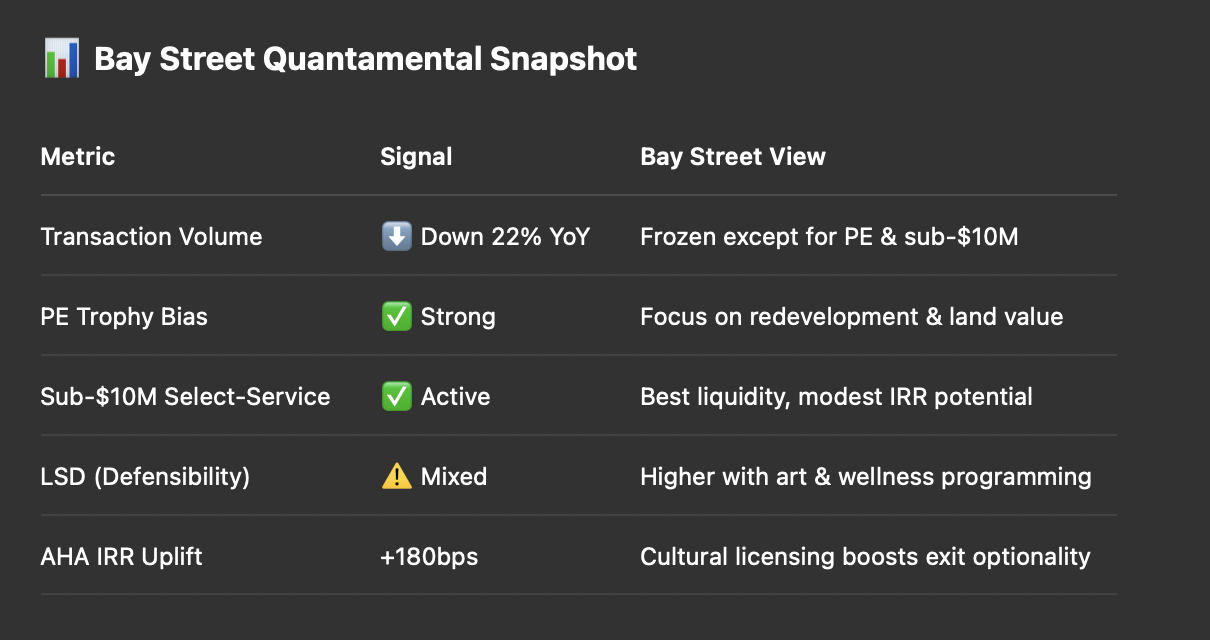

With CMBS debt delivering quasi-equity returns and interest rates unchanged, Jan Freitag’s point rings true: “If you don’t have to sell, you won’t.” For hospitality allocators, the bigger question is not when deal flow will return — it’s how to extract alpha in a market where most owners are waiting it out.

Bay Street’s Phase 13 Regime Detection confirms a “Hold Regime” in U.S. hospitality, driven by three macro factors:

Bay Street’s Bay Score volatility band for U.S. assets has widened by +60 basis points YoY, reflecting pricing uncertainty rather than operational weakness.

Bay Street’s AHA (Alpha Harvest Adjusted) scoring for the U.S. in 2025 recommends three strategic tilts:

Assets like Silver Sands Beach Resort (being razed for luxury condos) show that the highest IRR scenarios aren’t from running existing operations — they’re from repositioning. Cultural licensing, including art partnerships, enhances exit multiples, particularly in urban boutique markets.

This space remains the only liquid tier. Bay Street’s models show 7–8% IRRs with limited downside if paired with low-debt structures and ESG or wellness upgrades.

Historic hotels with narrative equity (think Boulder, Charleston, Aspen) offer LSD scores 20–30% higher when coupled with art licensing. As Management of Art Galleries reminds us:

“Sustainability of cultural venues lies in the story they keep alive, not the one they start.”

The muted U.S. deal flow shouldn’t push allocators to sit idle. The market is bifurcated: patient capital is buying trophies; nimble capital is trading sub-$10M select-service assets.

For Bay Street, the best plays are where cultural programming intersects with long-duration holds — creating experiential IP that compounds loyalty and valuation even in a frozen macro environment.

As we often remind LPs:

In a hold regime, the question isn’t “Who’s selling?” — it’s “Who’s quietly compounding?”

...