Singapore remains one of the highest-scoring markets globally in Bay Street’s Political Flexibility Index (PFI) (92nd percentile), offering regulatory stability and strong infrastructure. However, Marina Bay Sands is already a mature asset; incremental alpha now depends on narrative differentiation, not just scale.

Our Phase 13 Regime Detection classifies this project as a “Cultural Gravity Regime”, where success hinges on three key factors:

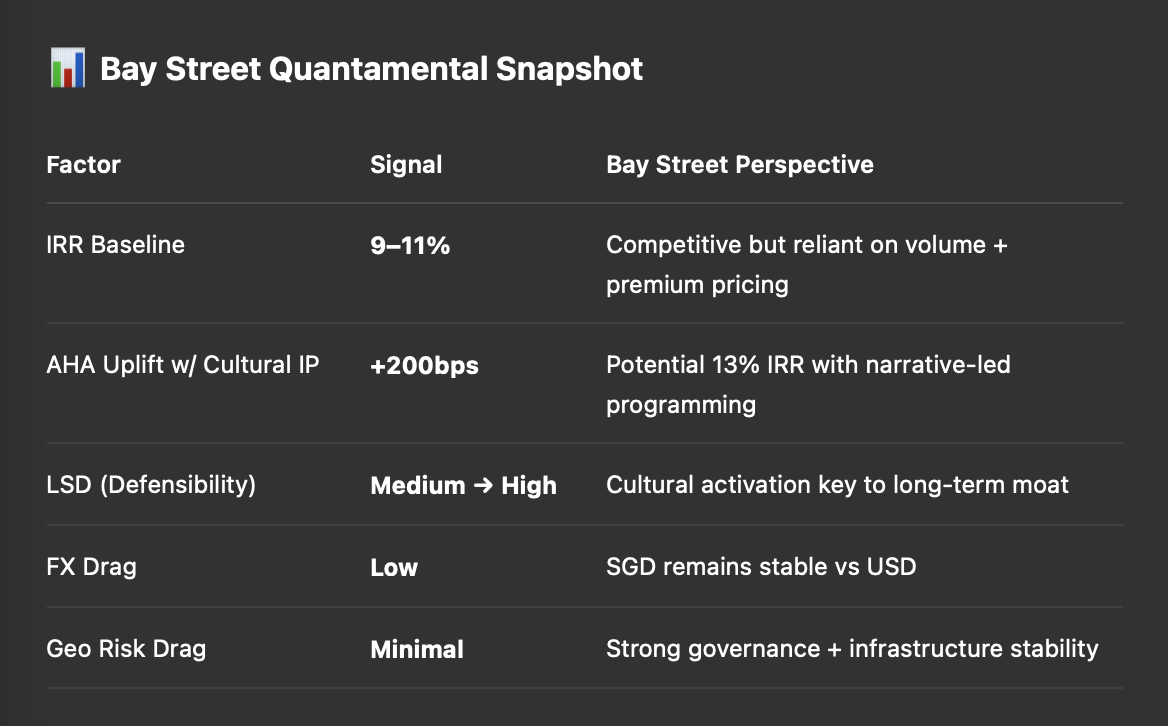

Bay Street’s AHA (Alpha Harvest Adjusted) projections estimate a 9–11% IRR baseline for this expansion, with potential uplift to 13% if cultural partnerships are effectively integrated.

In recent strategy sessions with prominent Asian art families in Hong Kong, Singapore, and Dubai, a recurring theme has emerged:

“Hotels are the new museums — but only if they treat art as a narrative, not wallpaper.”

One Singaporean collector of Southeast Asian contemporary works told us:

“Marina Bay is iconic, but it risks being sterile if it doesn’t speak to the region’s stories.”

This sentiment mirrors Art Collecting Today:

“Collectors no longer license for placement; they license for participation in the guest’s emotional arc.”

The Sands expansion offers unique potential for such licensed cultural programming:

Bay Street’s models show that culturally activated ultra-luxury assets achieve a 15–25% Loyalty Index uplift and command 10–12% higher ADR premiums compared to standard luxury operators.

Singapore’s luxury hospitality market has been dominated by brand trust and operational excellence, but cultural resonance remains underdeveloped. Competitors such as Raffles have begun experimenting with heritage storytelling, while Capella Singapore has seen loyalty boosts via art-driven programming.

The Sands expansion, if integrated properly, could establish Marina Bay as the first truly cultural luxury node in Southeast Asia, competing not just with Singaporean peers but with Hong Kong’s West Kowloon cultural district and Japan’s onsen-integrated luxury resorts.

Sands’ USD8 billion bet is not about rooms or gaming; it’s about cementing Marina Bay as a cultural and experiential capital.

As Management of Art Galleries reminds us:

“The venues that last are those that make people feel they are part of a story larger than themselves.”

For Bay Street, the key question isn’t whether the Skyloop will draw tourists — it will. The question is whether Sands will use its scale and capital to build a cultural operating system that compounds loyalty and yield over decades. If it does, this expansion could mark the start of Singapore’s transformation into a global cultural-hospitality benchmark

...