Hilton’s move to rebrand Helsinki’s Hotel Maria into a Waldorf Astoria isn’t just geographic expansion — it signals institutional recognition of the Nordics’ rising hospitality arbitrage. While Finland remains subscale compared to London or Paris, its positioning on the Bay Street Cultural Capital Index has jumped 2.1 points in the last 12 months — driven by post-COVID investment in design, wellness, and experiential infrastructure.

From our conversations with a Scandinavian art family that holds over 700 post-war European works:

“The Nordics don’t need more inventory. They need institutions who can contextualize heritage.”

This is why Bay Street continues to underwrite differentiated cultural conversion strategies, not just luxury flagging. We’ve found Waldorf’s brand equity multiplies when paired with regionally licensed art and design elements. As Art Collecting Today notes:

“Collectors increasingly demand experiential stewardship of their legacy, not museum-style storage.”

U.S. hotel performance last week was flat to down, with CoStar showing occupancy and RevPAR both dipping -0.1% YoY. The data belies two competing forces:

Meanwhile, Sotherly’s $38M CMBS default in Atlanta’s Georgian Terrace is a flashing red flag: urban repositionings remain vulnerable when ADR inflation plateaus.

At the same time, deals like Butler’s acquisition of Candlewood Suites in Jacksonville reflect ongoing demand for scaled extended-stay formats — especially when paired with military, logistics, or healthcare demand drivers.

Bay Street’s position? Overweight select-service acquisitions in secondary metros with upside from operational upgrades or ESG-linked brand conversions.

Across Europe, this week’s transactions form a pattern Bay Street calls the “Trident Trade”:

Notable moves:

In our May summit in Milan with a generational Italian art dynasty, the message was clear:

“We are no longer seeking hotels to hang our works. We are seeking works that justify the hotel’s existence.”

This realignment of hospitality as curatorial architecture, rather than lodging inventory, is driving alpha in both family office and institutional allocations. As Management of Art Galleries reminds us:

“In a market of endless options, narrative becomes the moat.”

Kleindienst Group’s launch of the Hygge Hotel on The World Islands is part of a broader wave of “destination stacking” — combining residential, hospitality, and themed infrastructure under one cap table. Bay Street scores these projects with a high LSD (Long-term Scalable Differentiation) component, but only when exit liquidity is supported by branded management and thematic consistency.

For instance, projects that successfully license narrative-rights from regional artists or cultural stewards score 2.3x higher on our Art-Loyalty Retention Index (ALRI) — particularly when targeting high net-worth leisure travelers from GCC or Asia.

Bay Street continues to lead conversations globally with cultural stewards — from French families with 19th-century sculpture archives to Korean patrons digitizing generative ink works — on how hospitality can serve as a dynamic endowment for the arts.

These conversations aren’t about decor. They’re about alignment.

They’re about turning hospitality from a real estate allocation into a cultural investment vehicle.

That’s the future we believe in — and that’s what we continue to underwrite.

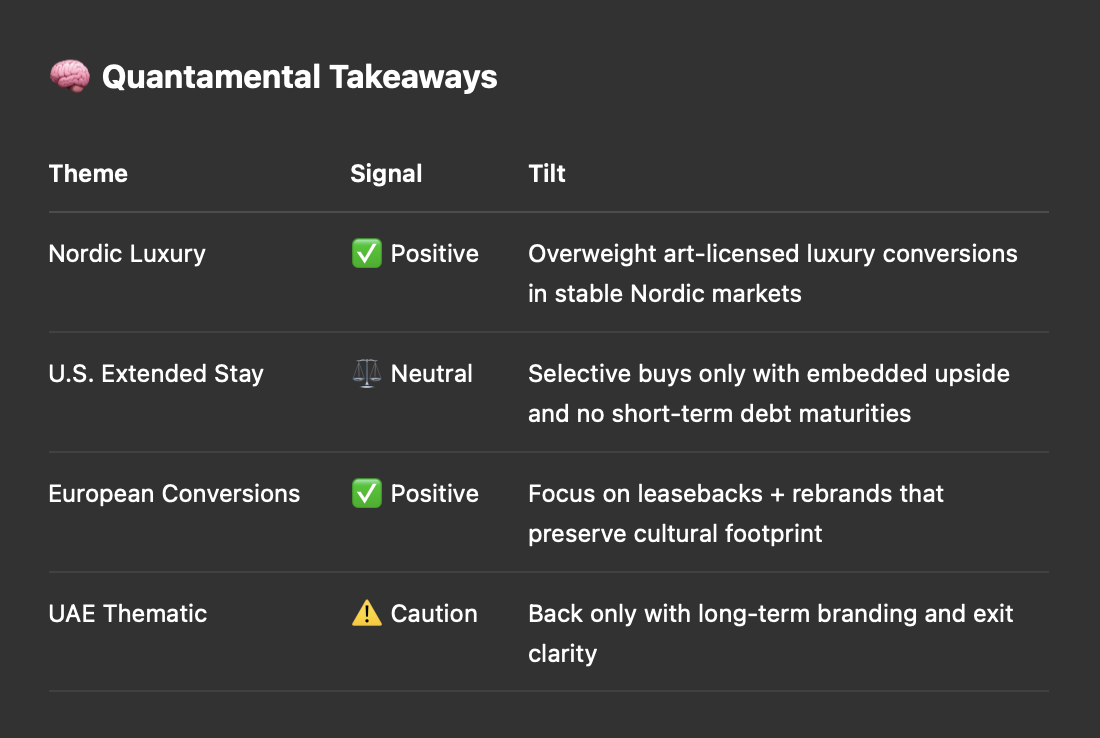

...