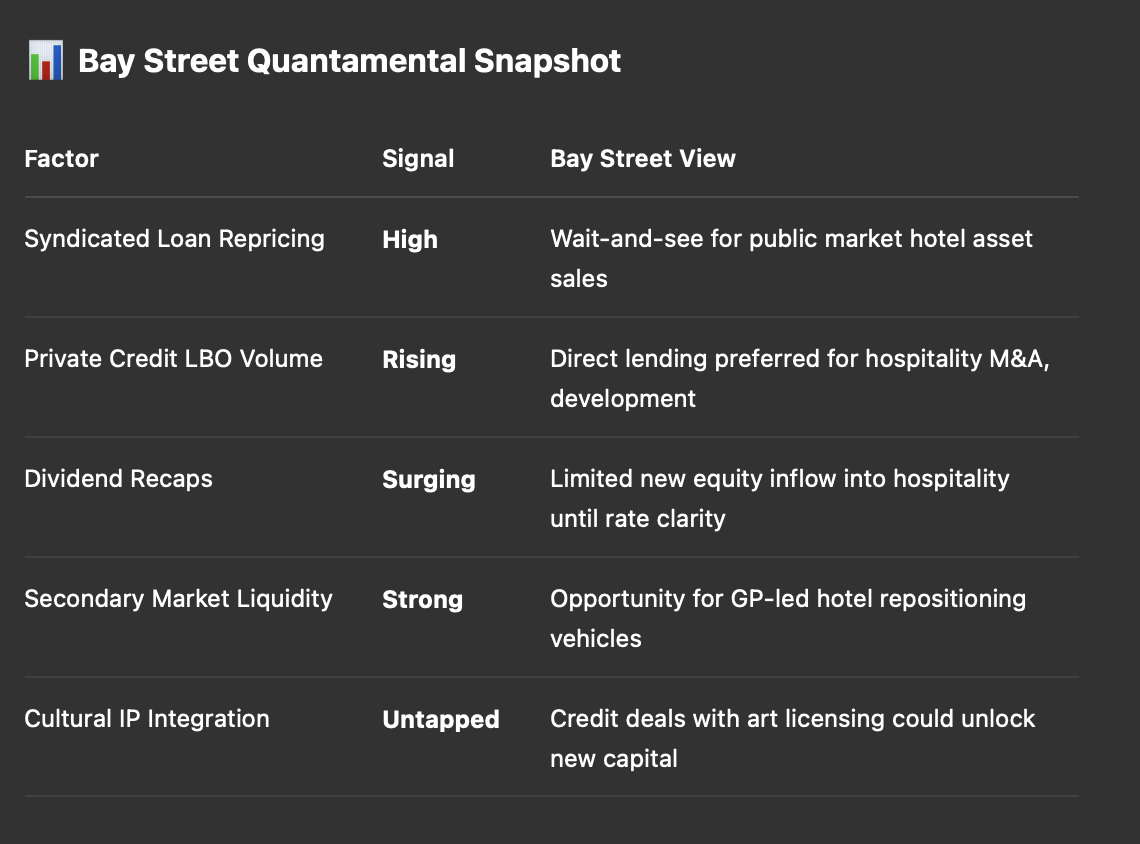

Bay Street’s Phase 13 Regime Detection categorizes the current credit landscape as a “Hold Regime” in public markets but an “Opportunistic Deployment Regime” in private credit.

For hospitality, this means institutional sellers will likely hold prime assets longer, waiting for rate clarity, pushing liquidity toward private bilateral negotiations rather than public auctions.

For Bay Street, this signals hospitality development and repositioning projects are more likely to secure financing via direct lenders, GP continuation vehicles, or structured private credit, especially for branded residence and wellness-hospitality hybrids.

In recent meetings with art families in Zurich, London, and Abu Dhabi, many expressed growing interest in credit-backed hospitality placements:

“We don’t just want equity in hotels; we want credit structures that allow us to influence the narrative while preserving downside protection.”

This mindset mirrors Art Collecting Today:

“The modern collector is a financier of cultural environments, not just an owner of objects.”

Bay Street sees structured credit deals with embedded cultural licensing rights as a potential game-changer — allowing art families to partner with operators, fund CapEx for curated spaces, and benefit from stable cash flows.

Imagine a branded residence or hotel refinancing supported by private credit, with part of the proceeds funding curated art installations or wellness-driven experiential programming — creating both cultural alpha and yield defensibility.

Hospitality investors shouldn’t view credit markets as separate from their equity thesis. The reality is credit is shaping who gets to buy, build, or hold hospitality assets in 2025.

The winners will be those who:

As Management of Art Galleries reminds us:

“The capital that lasts is the capital that funds meaning.”

For Bay Street, credit isn’t just the cost of capital — it’s now the cost of narrative.

...