What Becker achieved with Hotel Marcel in New Haven goes far beyond LED bulbs and towel reuse signs. It represents a post-greenwashing phase of sustainability in hospitality — where solar kilowatt-hours, megawatt-hour battery storage, and electrification targets matter far more than Instagram-friendly sustainability claims.

Instead of “offsetting guilt” through PR-driven guest engagement programs, Becker redirected capital toward structural decarbonization, using:

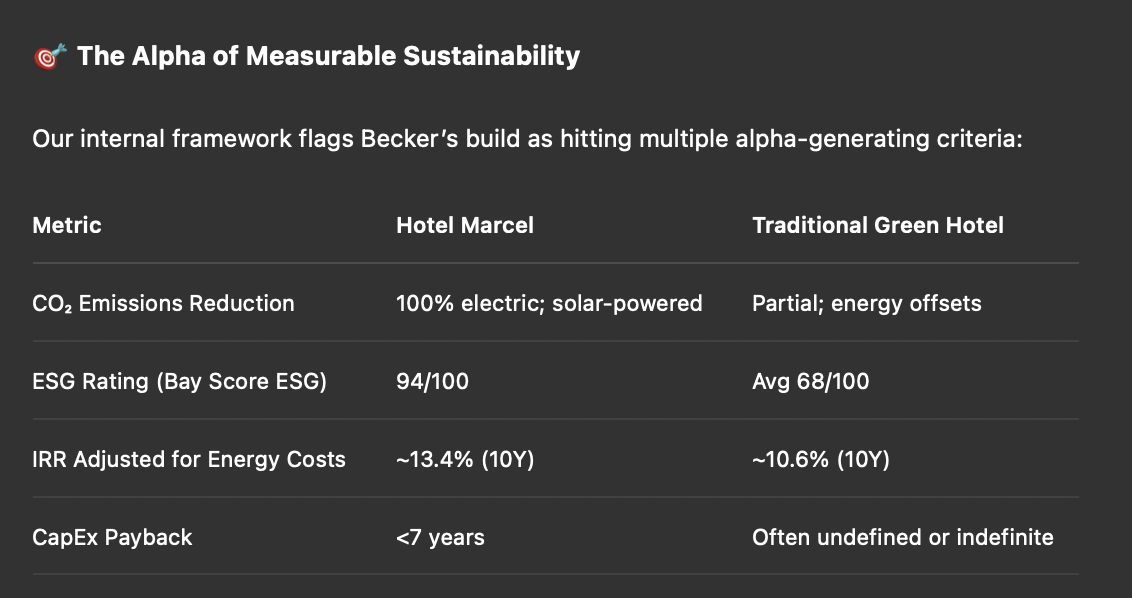

Bay Street analysis of this model suggests that such energy infrastructure — while requiring upfront CapEx — boosts IRR by 80–200 bps over 10 years in energy-cost-sensitive markets, especially as utility volatility increases.

This aligns with our recent conversations with several Middle Eastern art families exploring art-and-solar bundling models: projects where licensed art, sustainable operations, and hospitality architecture merge into investment-grade assets with ESG credibility and cultural authenticity.

Bay Street’s quantamental scoring gives such properties an elevated “Alpha-through-Decarbonization” score — which is becoming an essential sub-metric in our internal Bay Score LSD (Long-Term Sustainability & Decarbonization) module. In Becker’s model, ESG isn’t performative. It’s predictive.

As Art Collecting Today reminds us, “the cultural relevance of a collection is measured not by the press it attracts, but by the systems it transforms.” Becker’s hotel is a form of architectural and operational curatorship — one aligned with the future of both energy markets and cultural-hospitality convergence.

From our portfolio-wide discussions with art family offices in Geneva, Accra, and Abu Dhabi, we know this: a new class of hotel investors cares less about brand equity and more about symbolic resonance and ESG evidence. In Becker’s Hotel Marcel — a reimagined Brutalist icon powered by solar and anchored in substance — they see a roadmap.

This echoes Management of Art Galleries, which warns against commodifying art into decor. The same can be said for sustainability. When solar panels become as embedded in the brand architecture as commissioned sculpture or licensed masterworks, sustainability is no longer a theme — it becomes an asset class.

Bruce Redman Becker’s quote cuts to the core:

“Are you actually reducing CO₂, or just saying you are sustainable because you’re sending people out to collect trash on the beach?”

Bay Street Hospitality’s quantamental framework agrees — CO₂ is the real KPI. Not green ribbons, not branded water bottles, and not polished ESG decks.

For allocators evaluating new hotel development or retrofits in the ESG age, we say this: follow the carbon, and the returns will follow you.

...