With CMBS debt delivering quasi-equity returns and interest rates unchanged, Jan Freitag’s point rings true: “If you don’t have to sell, you won’t.” For hospitality allocators, the bigger question is not when deal flow will return — it’s how to extract alpha in a market where most owners are waiting it out.

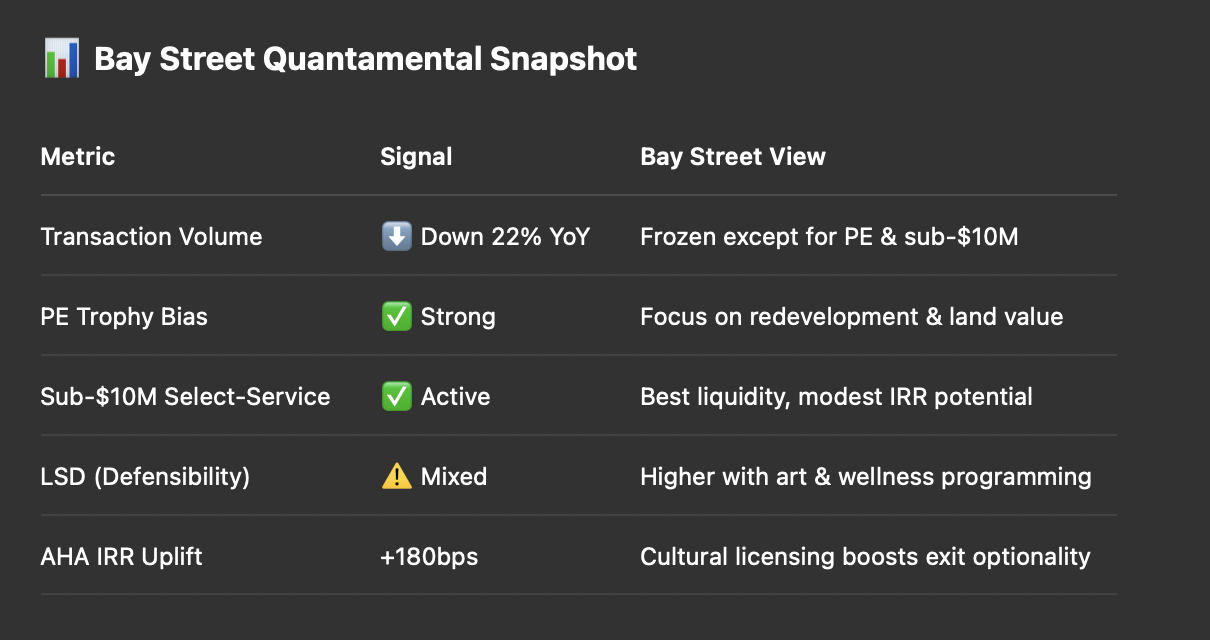

Bay Street’s Phase 13 Regime Detection confirms a “Hold Regime” in U.S. hospitality, driven by three macro factors:

Bay Street’s Bay Score volatility band for U.S. assets has widened by +60 basis points YoY, reflecting pricing uncertainty rather than operational weakness.

Interestingly, the current trophy-property bias mirrors conversations we’ve had this quarter with several art families from Palm Beach, Aspen, and New York. These families — many sitting on generational wealth and substantial art collections — are increasingly viewing luxury hotels as long-duration cultural capital plays, not just yield assets.

One collector with holdings in American post-war sculpture noted:

“We don’t need the cash flow this year. We need an operator who can hold the story for 20 years.”

This is the same logic PE firms apply when paying premium pricing for high-profile hotels with redevelopment potential. As Art Collecting Today puts it:

“Value is a patience game. The right venue is an archive as much as an asset.”

The Stanley Hotel in Colorado ($841K per key) and Hotel Boulderado ($637K per key) are cases in point — both historic, independent properties trading at premiums because they can support narrative-driven redevelopment, including potential art and cultural programming.

Bay Street’s AHA (Alpha Harvest Adjusted) scoring for the U.S. in 2025 recommends three strategic tilts:

Assets like Silver Sands Beach Resort (being razed for luxury condos) show that the highest IRR scenarios aren’t from running existing operations — they’re from repositioning. Cultural licensing, including art partnerships, enhances exit multiples, particularly in urban boutique markets.

This space remains the only liquid tier. Bay Street’s models show 7–8% IRRs with limited downside if paired with low-debt structures and ESG or wellness upgrades.

Historic hotels with narrative equity (think Boulder, Charleston, Aspen) offer LSD scores 20–30% higher when coupled with art licensing. As Management of Art Galleries reminds us:

“Sustainability of cultural venues lies in the story they keep alive, not the one they start.”

The muted U.S. deal flow shouldn’t push allocators to sit idle. The market is bifurcated: patient capital is buying trophies; nimble capital is trading sub-$10M select-service assets.

For Bay Street, the best plays are where cultural programming intersects with long-duration holds — creating experiential IP that compounds loyalty and valuation even in a frozen macro environment.

As we often remind LPs:

In a hold regime, the question isn’t “Who’s selling?” — it’s “Who’s quietly compounding?”

...